Or try one of the following: 詹姆斯.com, adult swim, Afterdawn, Ajaxian, Andy Budd, Ask a Ninja, AtomEnabled.org, BBC News, BBC Arabic, BBC China, BBC Russia, Brent Simmons, Channel Frederator, CNN, Digg, Diggnation, Flickr, Google News, Google Video, Harvard Law, Hebrew Language, InfoWorld, iTunes, Japanese Language, Korean Language, mir.aculo.us, Movie Trailers, Newspond, Nick Bradbury, OK/Cancel, OS News, Phil Ringnalda, Photoshop Videocast, reddit, Romanian Language, Russian Language, Ryan Parman, Traditional Chinese Language, Technorati, Tim Bray, TUAW, TVgasm, UNEASYsilence, Web 2.0 Show, Windows Vista Blog, XKCD, Yahoo! News, You Tube, Zeldman

TradingFxCfd

learn to trade forexMarkets Focus On Fed, BoE Fee Choices, UK CPI Slides 30 Dec 2024, 8:49 am

The US Federal Reserve (Fed) and the Financial institution of England (BoE) rate of interest choices stand out from the gang of vital monetary updates for the remainder of this week as traders and merchants shall be eager to see how these two main central banks plan to regulate their financial insurance policies.

The week began with a bang as the Financial institution of Japan (BoJ) raised its short-term rates of interest to 0% to 0.1% from -0.1% for the primary time after a few years, marking a pivot in its technique. On account of this landmark resolution, the Japanese yen hovers round a four-month low towards the US greenback.

Federal Reserve Curiosity Fee Determination

The Fed board will announce its resolution on rates of interest on Wednesday afternoon. Economists recommend that the Fed received’t decrease borrowing prices after its board assembly as it is going to seemingly wait to see extra concrete proof associated to the downward trajectory of inflation within the nation.

The CME FedWatch Device appears to be in keeping with the forecast talked about because it provides 99% likelihood for the benchmark rate of interest to stay unchanged in the present day. Chatting with CBS Information, economists at Commonwealth Monetary Community mentioned that “the Fed goes to be taking plenty of the oxygen out of the room this week as they conclude their March assembly on Wednesday afternoon. We have seen some combined financial information to start out the 12 months. It should be attention-grabbing to see how the Fed reacts to that, particularly in Fed Chair Jerome Powell’s post-meeting press convention.”

Goldman Sachs economists mentioned they forecast three cuts in 2024, down from its earlier forecast for 4 cuts this 12 months.

Financial institution Of England Curiosity Fee Determination

The Financial institution of England’s Financial Coverage Committee (MPC) is anticipated to announce its price resolution on Thursday afternoon. The so-called “Tremendous Thursday” in all probability received’t embrace any important adjustments on financial coverage as economists recommend that the BoE is poised to retain borrowing prices to the present 16-year excessive.

Nomura’s market analysts have been quoted by Yahoo Finance saying that “market pricing for the ECB, and to a lesser extent the BoE, has been largely pushed by Fed price expectations. Market individuals consider different central banks have a ‘concern of going first’, however we predict the macroeconomic cycles within the US and Europe are decoupling, which justifies the ECB and BoE going it alone and chopping charges independently of the Fed.”

Deutsche Financial institution economists famous: “Given weaker progress, weaker inflation, and weaker pay information, we predict an 8-1 vote tally now appears extra seemingly — with exterior MPC member [Swati] Dhingra voting for a price minimize. For now, we stick with our Could name for the primary price minimize. However our conviction ranges have fallen, particularly with little signalling from the MPC on when price cuts may start.”

UK CPI Inflation Drops In February

CPI inflation within the UK dropped to three.4% in February though analysts had anticipated inflation to come back in at 3.5%. It needs to be famous that the UK CPI stood at 4% in January. February’s determine is the bottom recorded since September 2021. The Workplace for Nationwide Statistics (ONS) report additionally confirmed core CPI (excludes vitality, tobacco, alcohol and meals) dropping to 4.5% from January’s 5.1%.

The UK Chancellor, Jeremy Hunt, mentioned that “this units the scene for higher financial circumstances, which may enable additional progress on our ambition to spice up progress.” The British pound misplaced some floor towards its rivals on Wednesday morning as decrease than anticipated CPI inflation might immediate the Financial institution of England (BoE) to contemplate decreasing borrowing prices sooner than anticipated.

Check Your Buying and selling Methods on an Admirals Threat-Free Demo Account

Are you interested by practising buying and selling with out risking your funds? A demo buying and selling account from Admirals lets you just do that, while buying and selling in lifelike market circumstances. Click on the banner beneath to open a demo account in the present day:

Register for a free on-line demo account and practise your buying and selling technique

This materials doesn’t comprise and shouldn’t be construed as containing funding recommendation, funding suggestions, a suggestion of or solicitation for any transactions in monetary devices. Please observe that such buying and selling evaluation just isn’t a dependable indicator for any present or future efficiency, as circumstances might change over time. Earlier than making any funding choices, you must search recommendation from unbiased monetary advisors to make sure you perceive the dangers.

2024 Buying and selling Hits $18.4 Trillion 30 Dec 2024, 8:43 am

Govt Interview with Nadia Edwards-Dashti | Harrington Star | FMLS:24

Govt Interview with Nadia Edwards-Dashti | Harrington Star | FMLS:24

Govt Interview with Nadia Edwards-Dashti | Harrington Star | FMLS:24

Govt Interview with Nadia Edwards-Dashti | Harrington Star | FMLS:24

Govt Interview with Nadia Edwards-Dashti | Harrington Star | FMLS:24

Govt Interview with Nadia Edwards-Dashti | Harrington Star | FMLS:24

Fintech Expertise within the UK: The Human Issue Driving Trade Change 🌟

What does it take to draw, retain, and upskill the very best fintech expertise in at the moment’s quickly evolving UK market? On this partaking interview, Nadia Edwards-Dashti, Chief Buyer Officer at Harrington Star, explores the way forward for expertise recruitment, the rise of gross sales roles, and the way AI is reshaping the trade—with out changing the human contact.

#fmls #fmls24 #fmevents #recruitment #financialcareers

📣 Keep up to date with the newest in finance and buying and selling!

Comply with FMevents throughout our social media platforms for information, insights, and occasion updates.

Join with us at the moment:

🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/

👍 Fb: https://www.fb.com/FinanceMagnatesEvents

📸 Instagram: https://www.instagram.com/fmevents_official

🐦 Twitter: https://twitter.com/F_M_events

🎥 TikTok: https://www.tiktok.com/@fmevents_official

▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official

Do not miss out on our newest movies, interviews, and occasion protection.

Subscribe to our YouTube channel for extra!

Fintech Expertise within the UK: The Human Issue Driving Trade Change 🌟

What does it take to draw, retain, and upskill the very best fintech expertise in at the moment’s quickly evolving UK market? On this partaking interview, Nadia Edwards-Dashti, Chief Buyer Officer at Harrington Star, explores the way forward for expertise recruitment, the rise of gross sales roles, and the way AI is reshaping the trade—with out changing the human contact.

#fmls #fmls24 #fmevents #recruitment #financialcareers

📣 Keep up to date with the newest in finance and buying and selling!

Comply with FMevents throughout our social media platforms for information, insights, and occasion updates.

Join with us at the moment:

🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/

👍 Fb: https://www.fb.com/FinanceMagnatesEvents

📸 Instagram: https://www.instagram.com/fmevents_official

🐦 Twitter: https://twitter.com/F_M_events

🎥 TikTok: https://www.tiktok.com/@fmevents_official

▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official

Do not miss out on our newest movies, interviews, and occasion protection.

Subscribe to our YouTube channel for extra!

Fintech Expertise within the UK: The Human Issue Driving Trade Change 🌟

What does it take to draw, retain, and upskill the very best fintech expertise in at the moment’s quickly evolving UK market? On this partaking interview, Nadia Edwards-Dashti, Chief Buyer Officer at Harrington Star, explores the way forward for expertise recruitment, the rise of gross sales roles, and the way AI is reshaping the trade—with out changing the human contact.

#fmls #fmls24 #fmevents #recruitment #financialcareers

📣 Keep up to date with the newest in finance and buying and selling!

Comply with FMevents throughout our social media platforms for information, insights, and occasion updates.

Join with us at the moment:

🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/

👍 Fb: https://www.fb.com/FinanceMagnatesEvents

📸 Instagram: https://www.instagram.com/fmevents_official

🐦 Twitter: https://twitter.com/F_M_events

🎥 TikTok: https://www.tiktok.com/@fmevents_official

▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official

Do not miss out on our newest movies, interviews, and occasion protection.

Subscribe to our YouTube channel for extra!

Fintech Expertise within the UK: The Human Issue Driving Trade Change 🌟

What does it take to draw, retain, and upskill the very best fintech expertise in at the moment’s quickly evolving UK market? On this partaking interview, Nadia Edwards-Dashti, Chief Buyer Officer at Harrington Star, explores the way forward for expertise recruitment, the rise of gross sales roles, and the way AI is reshaping the trade—with out changing the human contact.

#fmls #fmls24 #fmevents #recruitment #financialcareers

📣 Keep up to date with the newest in finance and buying and selling!

Comply with FMevents throughout our social media platforms for information, insights, and occasion updates.

Join with us at the moment:

🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/

👍 Fb: https://www.fb.com/FinanceMagnatesEvents

📸 Instagram: https://www.instagram.com/fmevents_official

🐦 Twitter: https://twitter.com/F_M_events

🎥 TikTok: https://www.tiktok.com/@fmevents_official

▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official

Do not miss out on our newest movies, interviews, and occasion protection.

Subscribe to our YouTube channel for extra!

Fintech Expertise within the UK: The Human Issue Driving Trade Change 🌟

What does it take to draw, retain, and upskill the very best fintech expertise in at the moment’s quickly evolving UK market? On this partaking interview, Nadia Edwards-Dashti, Chief Buyer Officer at Harrington Star, explores the way forward for expertise recruitment, the rise of gross sales roles, and the way AI is reshaping the trade—with out changing the human contact.

#fmls #fmls24 #fmevents #recruitment #financialcareers

📣 Keep up to date with the newest in finance and buying and selling!

Comply with FMevents throughout our social media platforms for information, insights, and occasion updates.

Join with us at the moment:

🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/

👍 Fb: https://www.fb.com/FinanceMagnatesEvents

📸 Instagram: https://www.instagram.com/fmevents_official

🐦 Twitter: https://twitter.com/F_M_events

🎥 TikTok: https://www.tiktok.com/@fmevents_official

▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official

Do not miss out on our newest movies, interviews, and occasion protection.

Subscribe to our YouTube channel for extra!

Fintech Expertise within the UK: The Human Issue Driving Trade Change 🌟

What does it take to draw, retain, and upskill the very best fintech expertise in at the moment’s quickly evolving UK market? On this partaking interview, Nadia Edwards-Dashti, Chief Buyer Officer at Harrington Star, explores the way forward for expertise recruitment, the rise of gross sales roles, and the way AI is reshaping the trade—with out changing the human contact.

#fmls #fmls24 #fmevents #recruitment #financialcareers

📣 Keep up to date with the newest in finance and buying and selling!

Comply with FMevents throughout our social media platforms for information, insights, and occasion updates.

Join with us at the moment:

🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/

👍 Fb: https://www.fb.com/FinanceMagnatesEvents

📸 Instagram: https://www.instagram.com/fmevents_official

🐦 Twitter: https://twitter.com/F_M_events

🎥 TikTok: https://www.tiktok.com/@fmevents_official

▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official

Do not miss out on our newest movies, interviews, and occasion protection.

Subscribe to our YouTube channel for extra!

Greenback edges decrease as yields slips; hefty annual achieve doubtless By Investing.com 30 Dec 2024, 8:32 am

Investing.com – The US greenback slipped barely Monday, as US bond yields retreated, however remained close to latest highs as the top of the yr attracts close to.

At 04:5 ET (09:55 GMT), the Greenback Index, which tracks the dollar towards a basket of six different currencies, traded 0.1% decrease to 107.690.

Nonetheless, the index was nonetheless on target for month-to-month good points of over 2%, bringing year-to-date good points to virtually 7%.

Greenback on target for hefty annual good points

The greenback has been helped by rising US Treasury yields, with the benchmark 10-year notice hitting a greater than seven-month excessive final week. This yield, nonetheless, slipped by to 4.599% on Monday.

The election of Donald Trump as the brand new president additionally gave the greenback a lift as his insurance policies of looser regulation, tax cuts, tariff hikes and tighter immigration are seen as each pro-growth and inflationary, and are prone to preserve the Federal Reserve from chopping rates of interest quickly subsequent yr.

The US central financial institution projected simply two 25 bp fee cuts in 2025 at its final coverage assembly of the yr earlier this month, and markets at the moment are pricing in nearly 35 foundation factors of easing for 2025.

Buying and selling ranges are prone to be tight this holiday-impacted week, and the main target shall be on weekly numbers on Thursday and knowledge a day later, in addition to feedback from FOMC member .

Euro good points after Spanish inflation

In Europe, rose 0.1% to 1.0439, bouncing barely after knowledge confirmed that Spain’s annual EU-harmonized rose to 2.8% in December, up from the two.4% determine recorded in November.

The reduce rates of interest earlier this month and signaled extra cuts forward as financial development within the area stagnates.

Nonetheless, the following rate of interest reduce might be longer in coming after a latest uptick in inflation, ECB Governing Council member Robert Holzmann was quoted as saying on Saturday.

accelerated in November to 2.2% from 2.0% a month earlier and above the ECB’s 2% goal fee.

traded 0.1% greater to 1.2595, with little in the best way of UK financial knowledge to check forward of Thursday’s launch.

That’s anticipated to point out that the nation’s manufacturing sector remained firmly in contraction in December, after knowledge confirmed that Britain’s financial system didn’t develop within the third quarter.

Financial institution of England policymakers voting 6-3 to maintain rates of interest on maintain on the assembly earlier this month, a extra dovish cut up than anticipated, suggesting fee cuts will proceed subsequent yr.

Yen stays weak; danger of intervention helps

In Asia, traded largely flat at 157.76, round five-month highs for the pair, with solely the chance of Japanese intervention stopping one other check of the 160 degree final seen in July.

The signaled that it’ll take its time to think about extra rate of interest hikes after the central financial institution held rates of interest regular at 0.25% at this month’s assembly.

rose 0.2% to 7.3136, remaining near a one-year excessive because the prospect of extra fiscal spending and looser financial situations within the coming yr weighed on the forex.

How To Apply Danger Managment In Shares (The Full Information) 30 Dec 2024, 8:28 am

What’s the very first thing new merchants often be taught when beginning buying and selling?

Maybe… Transferring averages?

Chart patterns?

Assist & Resistance, perhaps?

How about Candlesticks Patterns?

Technical evaluation has probably the most enticing subjects in any case, proper!

Nonetheless, whereas these ideas may help you enter and handle a commerce…

…they received’t hold you within the sport in the long term.

To present your self an opportunity at retaining your portfolio intact, you want a vital lesson in…

Danger administration!

And that, my pal, is what I’ve ready for you at this time.

Particularly, you’ll be taught…

- The only and quickest threat administration technique to use in shares

- A exact threat administration technique that lets you be versatile together with your threat on the inventory market

- Accessible place sizing calculators that you should utilize anytime with out registering or downloading something

- Superior tips about tips on how to management your threat relying available on the market situation and your buying and selling technique

Now, this coaching information is greater than only a Wikipedia entry on threat varieties.

I’ll present you precisely tips on how to apply these strategies and which instruments you should get began at this time.

Sound good?

Then let’s start!

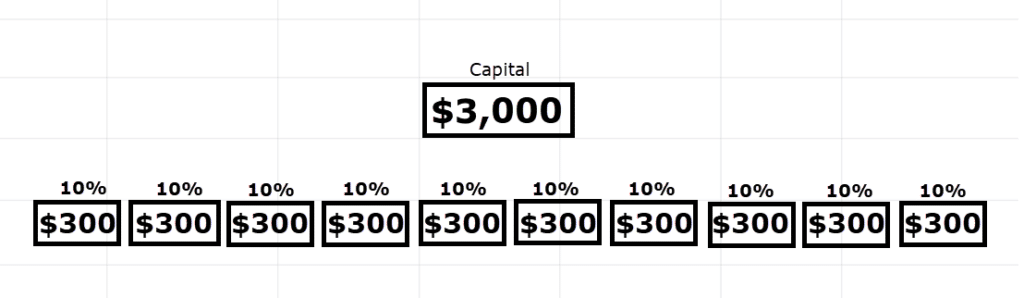

Methods to apply threat administration in shares: Portfolio allocation technique

On this part, I’ll train you the precise calculations for the way place sizing works.

…so that you simply perceive precisely tips on how to recreate them your self!

Now, this place sizing technique is greatest used:

- For diversifying your portfolio

- For each buying and selling and investing

- For any type of buying and selling or investing when not coping with leverage

The portfolio allocation technique works by setting a “mounted proportion” restrict when shopping for a inventory.

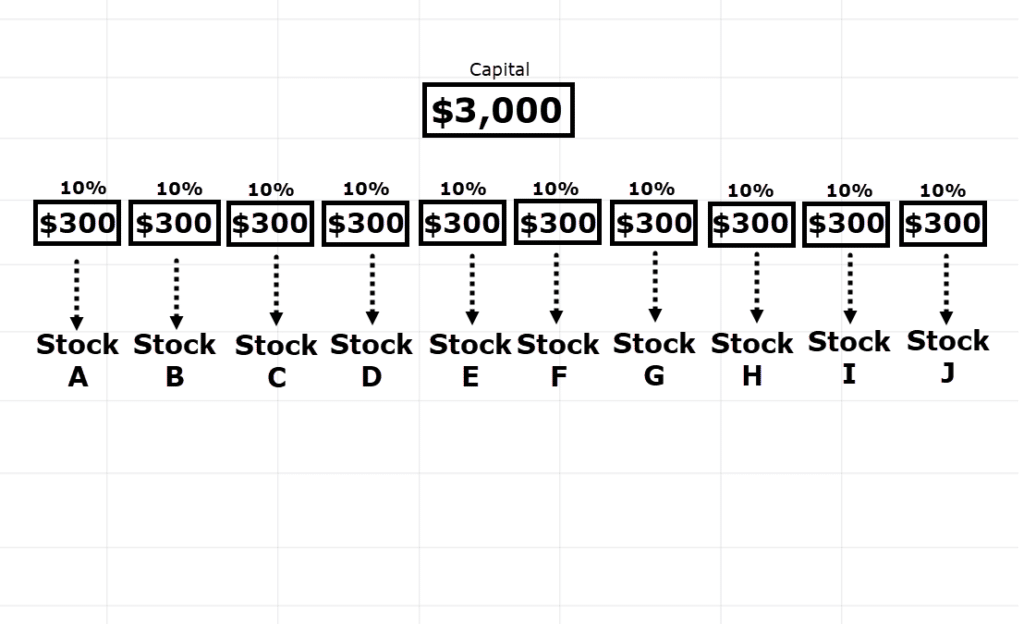

For instance, say you’ve gotten a $3,000 buying and selling account.

And let’s say that you simply wish to have a most allocation of 10% per commerce.

Which means in the event you’re inquisitive about shopping for a inventory, you don’t wish to purchase shares value greater than $300…

And by now…

It’s best to see that having a ten% allocation provides you a most open commerce of 10…

Make sense?

However you is likely to be questioning…

“Okay, however how does this work in the actual world?”

“How precisely do I calculate what number of shares to purchase when the inventory’s worth is $1.92?”

Let me present you…

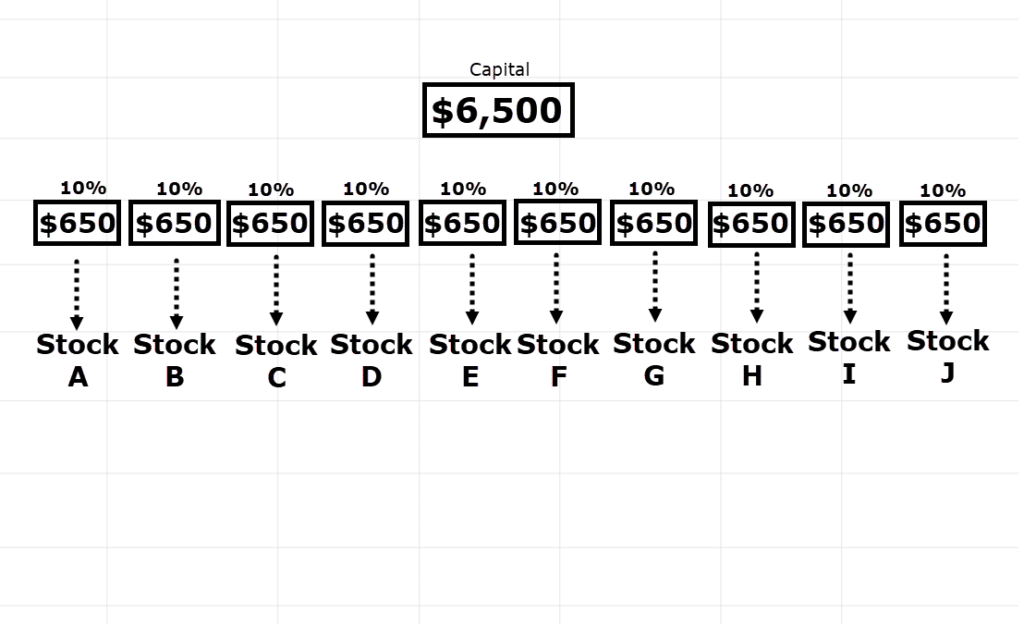

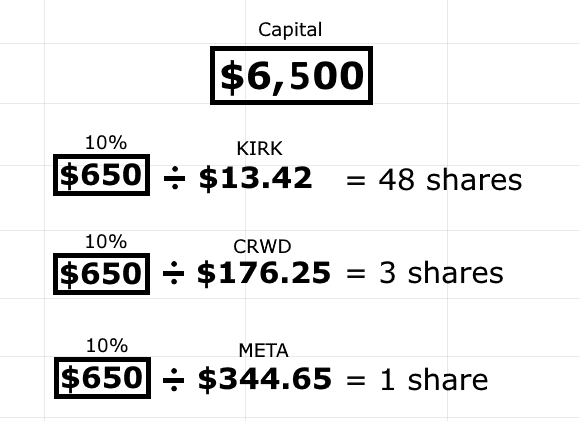

This time, let’s say that you’ve a $6,500 buying and selling account.

And {that a} 10% allocation signifies that you’ll purchase shares value as much as $650.

This offers you a most open commerce of 10…

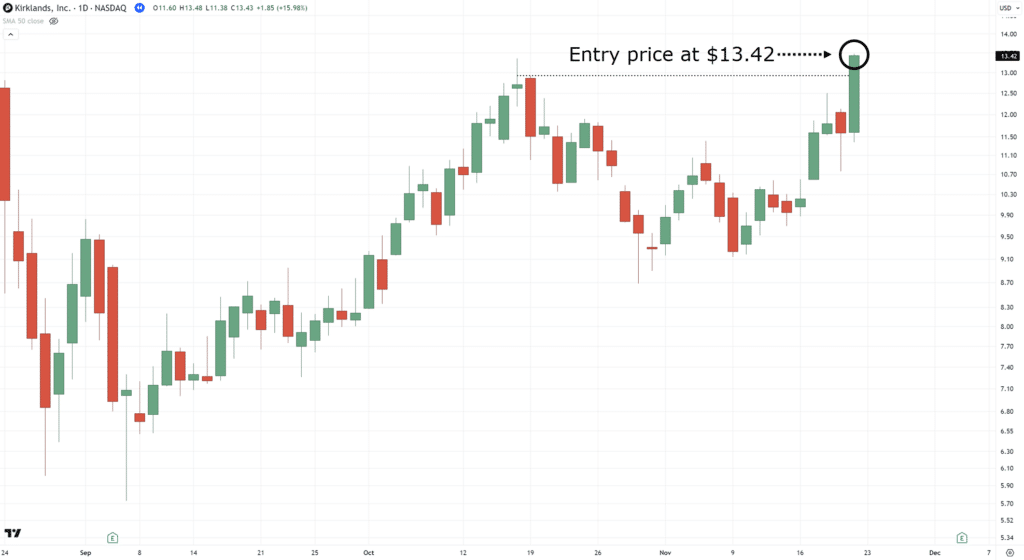

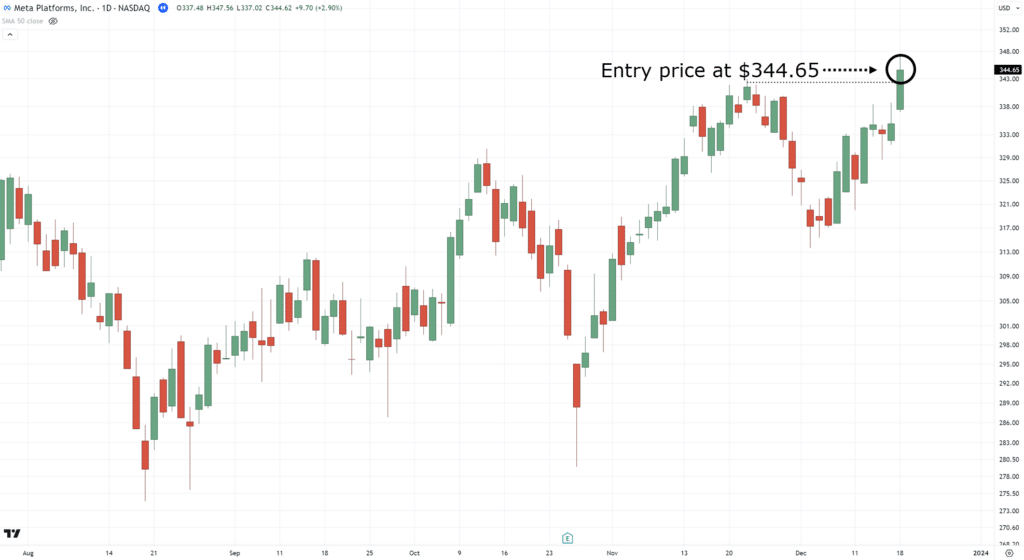

Now, you discover three shares you want (as a result of they’re presently on a breakout!)…

The query now’s…

What number of shares can I purchase?

First, take their closing costs:

- KIRK – $13.42

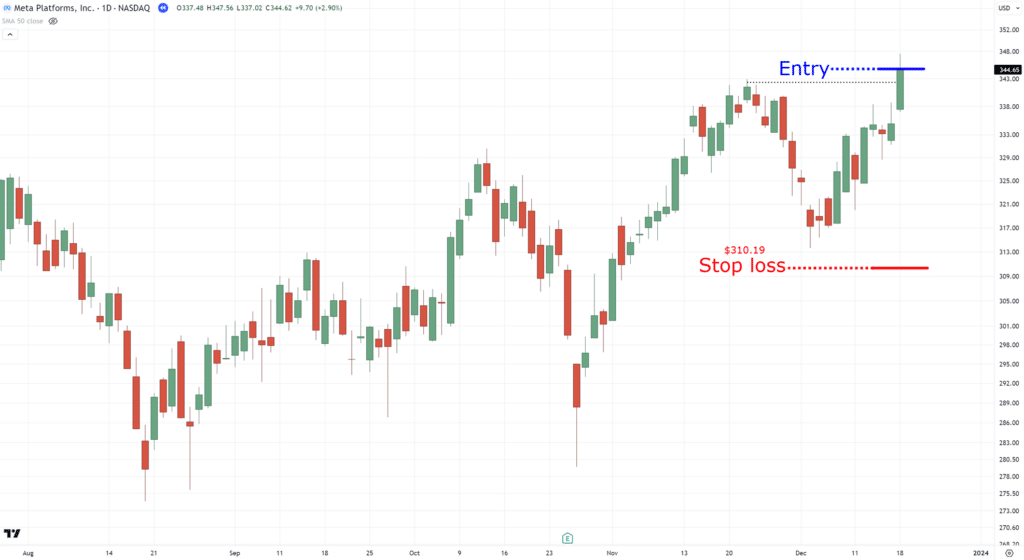

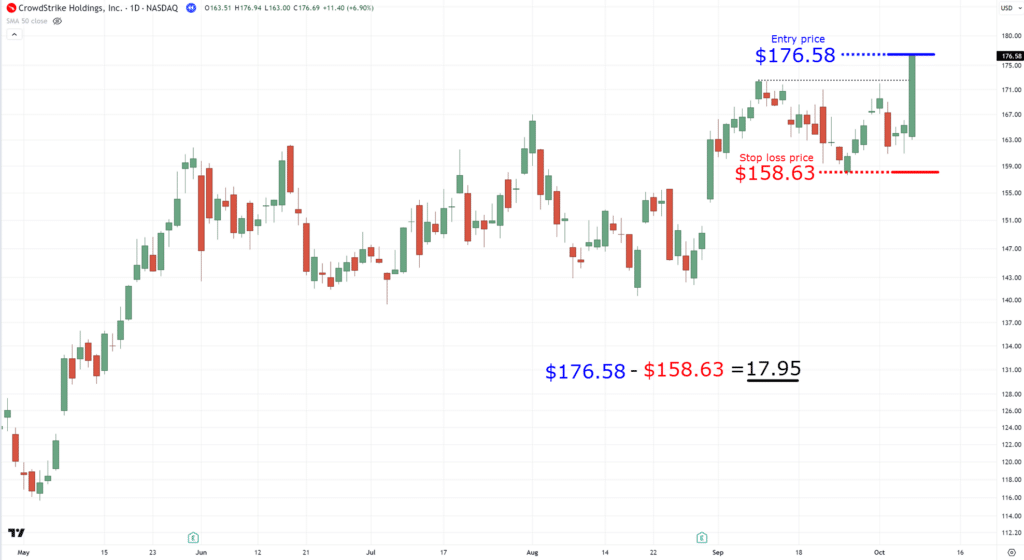

- CRWD – $176.25

- META – $344.65

The following factor you do is divide these closing costs by your 10% allocation quantity, $650…

And voila, now precisely what number of shares to purchase!

(And sure, you’ll wish to “spherical down” the calculation as you don’t wish to allocate greater than 10%)

Now, you is likely to be questioning…

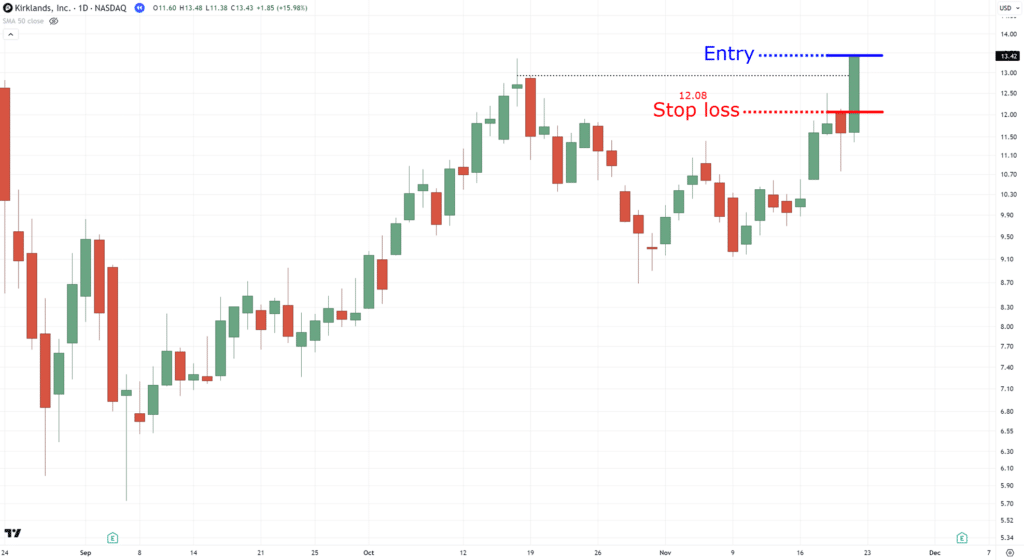

“The place do I place my cease loss?”

And that could be a excellent query!

Merely talking, calculate it by subtracting 10% of the final closing worth…

By doing so, it signifies that in case your cease loss is hit…

…you’ll lose not more than $65.

I’ll clarify extra about this idea shortly, however figuring out the fixed-percentage cease loss goes hand-in-hand with the portfolio allocation technique.

Received it?

So, let’s transfer on to the following place sizing technique…

Methods to apply threat administration in shares: Share technique

So, in the event you’re buying and selling with shares with none leverage, then utilizing portfolio allocation place sizing is smart.

Nonetheless, if you’re buying and selling with leverage, then figuring out this proportion place sizing is essential.

Within the earlier threat administration technique, the system was easy:

Shares to purchase = (Portfolio stability x 10% allocation) / Inventory worth

…however this time, you should ramp issues up just a bit!

Now, earlier than I share with you some formulation right here, I need you to know the precept of this threat administration technique:

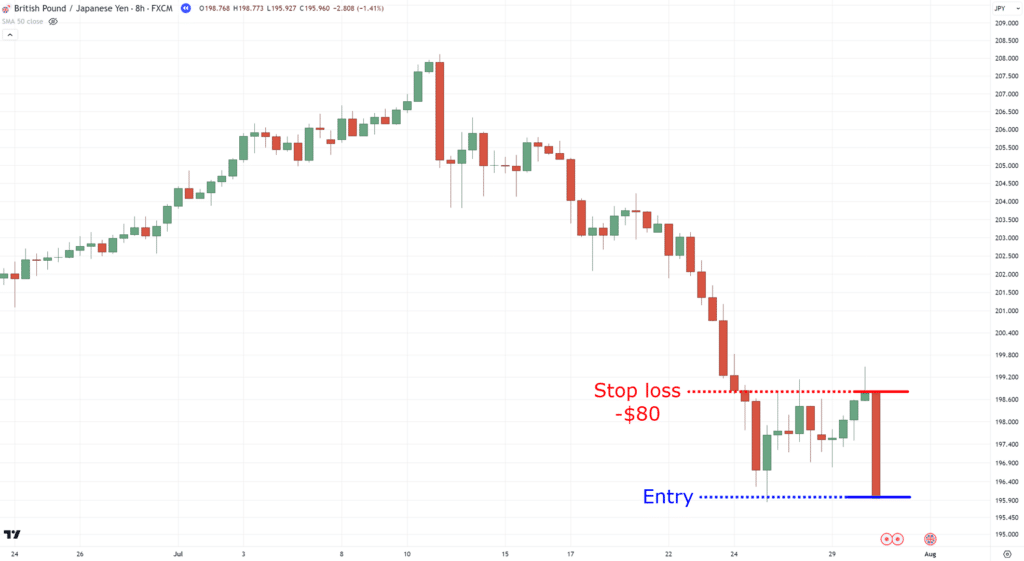

In case your cease loss is hit, you place measurement in a means that you simply solely lose 1% of your account stability

So, for instance…

You will have an $8,000 account, 1% of that capital is $80.

Which means if my cease loss is hit, I wish to guarantee that I don’t lose greater than $80 on my general portfolio.

Once more, this so-called “1%” differs from the allocation, because it refers back to the cease loss.

However you would possibly ask:

“What makes this place sizing technique good?”

Properly, the fantastic thing about it’s that you may be versatile in the place you place your cease loss.

You may place a good cease loss, and nonetheless just remember to solely lose 1% when your cease loss is hit…

You may have a large cease loss, and nonetheless just remember to solely lose 1% when your cease loss is hit…

See what I imply?

This offers you flexibility on the place you wish to place your cease loss, as your potential loss will stay static.

So, again to the query:

How do you apply this?

For shares, go by this equation…

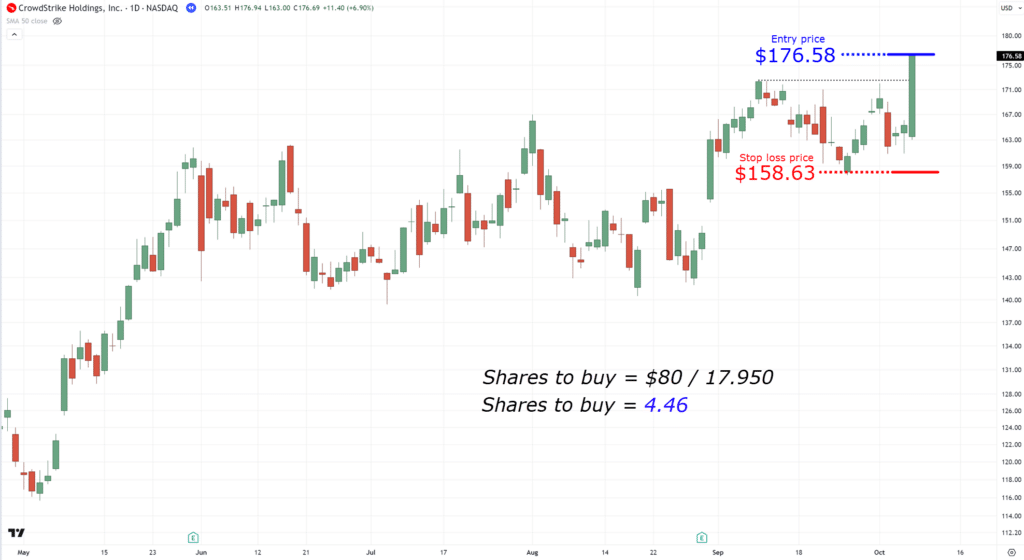

Shares to purchase = Danger quantity / (entry worth – cease loss worth)

Let’s take the earlier instance as an example.

I first have to subtract the entry worth and the cease loss worth…

Lastly, I simply divide it by 1% of my $8,000 account, which is $80!

After doing these calculations, you possibly can work out what number of shares to purchase…

On this case, in the event you purchase 4 shares at that entry worth, even when your cease loss is hit, you’ll not lose greater than $80.

Nonetheless with me?

Nice!

As a result of from right here on, issues get a complete lot simpler…

Subsequent, I’ll share with you totally different instruments on how one can apply threat administration to shares.

Methods to apply threat administration in shares: What instruments do you have to use?

The objective of this part is to automate your threat administration.

Alright, I do know what you’re pondering proper now:

“Why didn’t you begin with this within the first place?”

Properly, nothing feels higher than proudly owning the data you realized – and it makes extra sense than blindly following another person’s calculation, proper?

So, listed here are some primary standards I’ll lay down for what sort of threat administration instruments you’ll use:

- The danger administration instrument should be free (no registration required)

- The danger administration instrument should be simple to make use of and perceive

- The danger administration instrument should require no set up or obtain

Sound superior?

Properly, I meant it once I stated that you may apply every part you realized as quickly as you end this buying and selling information!

So, what’s the instrument that meets these standards?

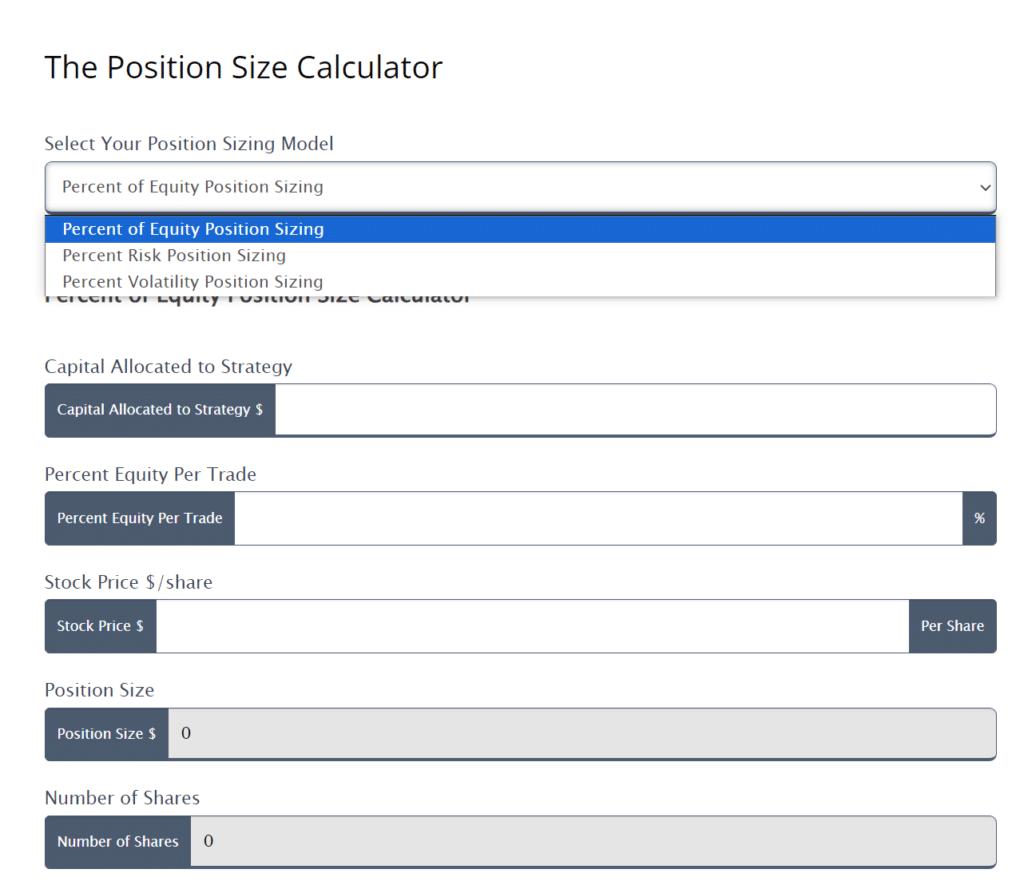

The most effective position-sizing instrument for shares

Happily, this instrument was launched very lately – whereas I used to be penning this information for you, in reality!

So, to present correct credit score… it’s the place sizing instrument of Adrian Reid:

Enlightened Inventory Buying and selling’s Place Dimension Calculator

What I really like about this instrument is that it’s an all-in-one resolution, supplying you with every part you should find out about tips on how to apply threat administration on shares.

Think about automating every part you’ve realized on this information thus far… multi functional place!

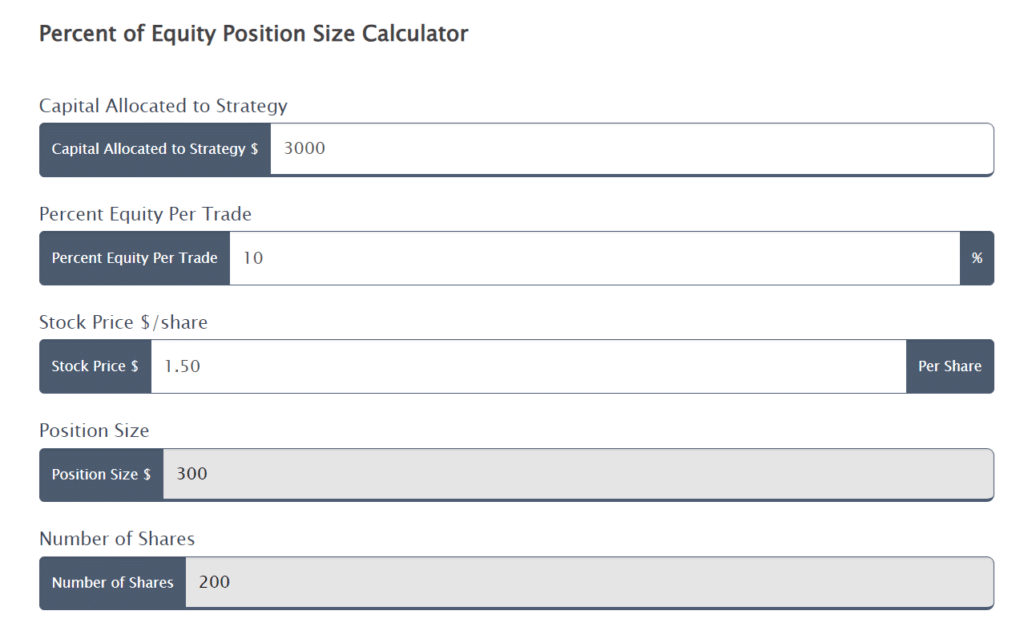

For instance, let’s say you’ve gotten a capital of $3,000, and also you’re allocating 10% of your capital per inventory.

And let’s say the inventory’s worth on entry is $1.50 per share.

What number of shares do you purchase?

Properly, simply plug within the numbers…

then bam!… you get 200 shares to purchase!

Straightforward-peasy!

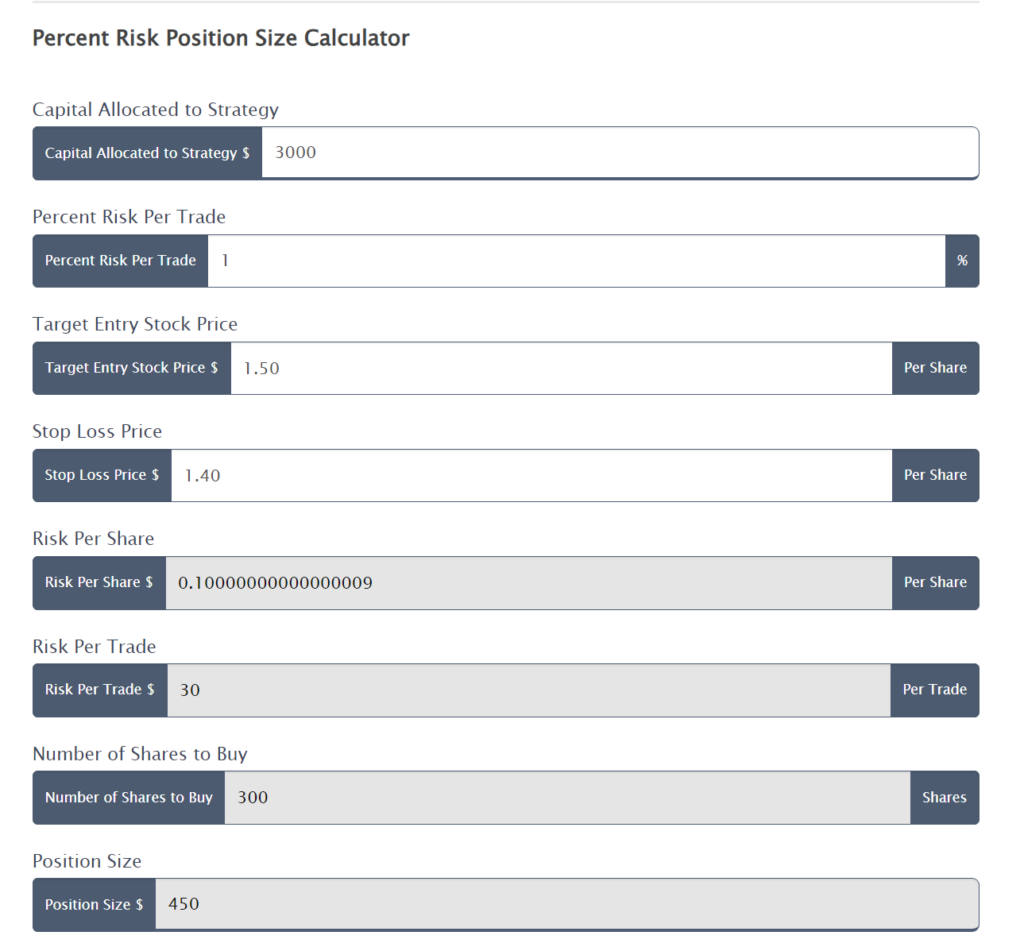

However how concerning the different place sizing technique I shared with you?

Sure, the web site has that, too…

Within the instance above, I positioned the identical capital quantity.

However this time, I entered that I’d be risking 1% per commerce, that the inventory’s entry worth is $1.50, and I needed the cease loss at $1.40.

And what have you learnt – I can purchase 300 shares primarily based on the calculation!

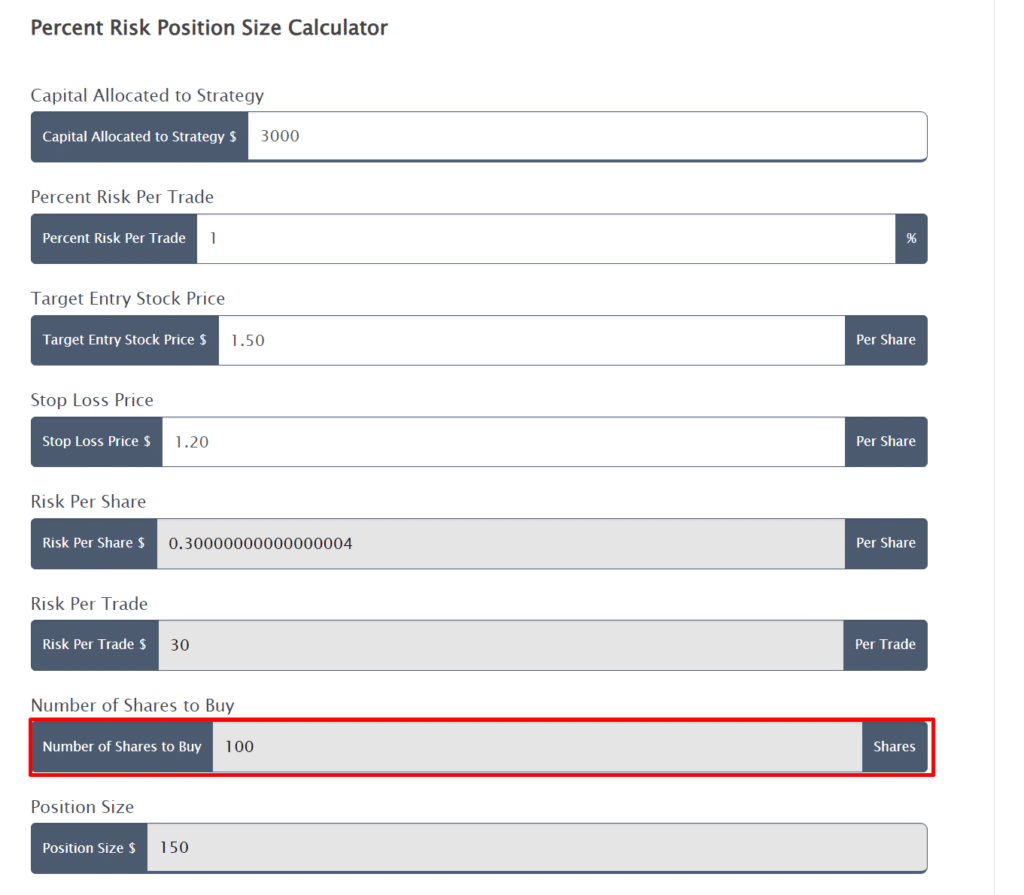

OK, however what in the event you felt that the cease loss distance was too tight and needed to put it out additional?

Properly, that’s the fantastic thing about this explicit threat administration technique, my pal!

You may be versatile about the place you wish to place your cease loss however nonetheless keep threat.

So, in case your cease loss now’s decrease, at $1.20…

The calculator exhibits that I’d wish to enter this commerce with 100 shares.

It’s a wider cease loss, however nonetheless the identical threat, at not more than 1% per commerce.

Fairly neat, proper?

And though I’m certain there are much more calculators on the market that totally automate this course of…

…or buying and selling platforms that have already got built-in threat administration calculators in them, too…

On this case, I wish to do my greatest to share probably the most accessible calculators on the market with you.

I definitely didn’t wish to spend half of your studying time on tips on how to register with sure brokers or set up particular indicators in your platform!

Now, within the subsequent part, I’m going to construct on what you’ve realized on this information thus far.

Possibly you seen I at all times ask you to threat 1% of your account per commerce or allocate 10% of your account per commerce?

However…. when can you modify these numbers?

When do you have to threat 0.5% per commerce?

How about 2% per commerce?

And what about allocation?

When do you allocate 20% of your capital per commerce on a single inventory?

How do you go about it?

Learn on to search out out!

Methods to apply threat administration in shares: The key to altering the parameters

So, the way you modify your threat relies upon available on the market situation and what kind of buying and selling type you’ve gotten.

That’s why, on this closing part, I’ll share with you tips on how to apply:

- Danger administration for bull markets within the inventory markets

- Danger administration for bear markets within the inventory markets

- Danger administration for intraday buying and selling in shares

Let’s take a better look…

Danger administration for bull markets within the inventory markets

There’s a typical saying:

“When it’s a bull market, every part you contact turns into gold…

…however every part you contact turns to shit in a bear market!”

It’s exactly why it is best to capitalize on a bull market when it comes however be defensive throughout a bear market.

As , the widespread proportion for portfolio allocation is 10%, which supplies you a most of 10 open trades.

However think about being extra aggressive in your portfolio allocation each time a bull market happens.

That is achieved, for instance, by allocating 12.5% per inventory, supplying you with 8 most open trades.

It concentrates your portfolio a bit extra, which means you would face higher losses but additionally make higher returns.

And in the event you want to go for probably the most aggressive portfolio allocation proportion, you possibly can allocate 20% per inventory, supplying you with a most open commerce of simply 5.

So, by utilizing this idea, you achieve extra flexibility to have interaction together with your account, attempting to capitalize on the tide of a bull market.

Danger administration for bear markets within the inventory markets

Admittedly, in a bear market, it doesn’t must be the case that every part you contact turns to shit.

It simply signifies that discovering an “outlier” trending inventory throughout a sea of blood is way tougher!

So, you’ve gotten two choices.

First, you possibly can keep in money.

Second, you allocate much less, comparable to a most of 5% per inventory, supplying you with a most open commerce of 20.

In fact, you at all times wish to enter trades with a sound buying and selling technique, too.

However one other vital query is:

“Why are you doing it like this, with so many open trades?”

The reply, my pal, is so as to improve your odds with a bigger pattern measurement of open trades.

Likelihood is, plenty of these shares you’re holding throughout a bear market will probably fail.

Nonetheless…

As soon as you see a golden egg in your basket in the midst of a bear market, it’s time to promote your laggards and scale them into your winners!

Principally, the idea is that on a bull market, you’d wish to be extra aggressive.

However on the bear market, you’d wish to be extra defensive.

Make sense?

Good, since you’ve simply completed a whole information on tips on how to apply threat administration in shares!

With that stated, let’s go over a abstract on what you’ve realized at this time.

Conclusion

Right here’s the reality:

Understanding tips on how to apply threat administration in shares should come first (and positively not final!)

Taking your time over it ensures you don’t blow by means of your account, irrespective of what number of occasions you mess up!

And within the worst-case state of affairs?

Your portfolio bleeds, supplying you with sufficient time to be taught out of your errors and seal the wound.

So, right here’s a fast recap of what you’ve realized at this time…

- A portfolio allocation place sizing technique is likely one of the most dependable methods to commerce markets with none leverage.

- Having a risk-based proportion place sizing is a little more sophisticated to use, however provides you each the flexibleness of putting your cease loss anyplace whereas additionally managing

- There are free and accessible place sizing calculators prepared so that you can entry, comparable to calculators from Enlightened Inventory Buying and selling.

- On a bull market, think about allocating extra shares per inventory, however on a bear market, you should be defensive by allocating much less.

So, there’s your full information, from newbie to superior, on how one can surgically management the chance parameters of your portfolio!

However really, I wish to hear what you assume.

What are another threat administration strategies of?

And in the event you commerce crypto or foreign exchange, how do you apply threat administration there?

Let me know within the feedback beneath!

Nothing Has Modified In Crypto • No Nonsense Foreign exchange 30 Dec 2024, 8:08 am

Bear in mind a month in the past? All of these thrilling narratives?

They’re all nonetheless right here.

Did you assume they went away simply because value is down??

Why? How?

As a result of value is down and also you’re feeling poopy?

The one “narrative” which can really die, fortunately is the place lots of sensible rich public individuals have forecasted Bitcoin to $90-200K by the tip of this 12 months.

You hopefully have been round lengthy sufficient to name the UNDER each time this occurs. I’d like to be incorrect, however….

At all times take care of information, and possible outcomes. If you are able to do that, you’ll be simply advantageous.

Let’s check out what was occurring a month in the past, and remains to be occurring with zero change by any means.

Record

Bitcoin topped out round $73K, and sits within the $59K vary now, after dropping to the $57K vary this week.

That’s fairly a drop. Should be one thing actually huge, no?

It’s not. To me, it’s manipulation because it typically is. However that’s not what we’re speaking about at this time.

The thrilling fundamentals which existed at $73K nonetheless exist now simply as a lot as they did again then. Nothing has modified.

These are simply a few of these fundamentals. I cannot go into an excessive amount of element as a result of you are able to do that if you’d like, and I’ve physician and dentist appointments in the identical day at this time, as a result of why be completely satisfied on a Thursday?

1 – Institutional cash isn’t even near being right here but

We all know this as a result of establishments within the US no less than are required to file a 13F type to reveal their holdings.

The excellent news is that a number of of them have purchased BTC by way of ETFs, which implies the need is there, however there may be sooooo a lot potential cash nonetheless to return by means of these autos. Nothing has modified.

And these individuals don’t fall for the sentiment traps like the general public does, so low costs for them are good.

And I suppose cause 1A could be how sovereign nations haven’t misplaced curiosity within the slightest both. Anticipate to see extra shopping for there too as we transfer alongside.

2 – VC cash nonetheless pouring in.

Which is loopy contemplating rates of interest all around the world. Cash is dear to borrow. However they see the upside, and your high tasks haven’t any issues getting funded proper now. Even shitty ones are getting funded too.

3 – Gaming remains to be occurring

Did you assume one thing modified right here? It was like I saved saying — we’re nonetheless too early within the cycle it doesn’t matter what Alex Becker says. Ultimately, he might be proper, accumulating now might be the transfer, however you may get tokens he liked and nonetheless loves close to the degrees they had been earlier than he even started to say them.

And why wouldn’t you? They had been thrilling again then, you imply to inform me they’re not anymore?

Nothing has modified. Aside from the value after all, which is way extra engaging now than it was in January.

My prediction for Web3 Gaming was how 2024 goes to be the perfect time to build up, after which we see the actual first wave of curiosity exterior the sector when lots of these video games totally launch in 2025.

With different sectors like DEFI 2.0, RWAs, AI, and many others, I nonetheless assume we’re nonetheless a cycle away right here earlier than we get our first batch of actual long-term winners.

4 – Fugazi tokens are telling you they’re fugazi

In the event you’re questioning whether or not or not that mid-low cap token you’re keen on a lot really does have potential — go look and see how a lot it has fallen. If it’s greater than common, chances are high its bigger buyers knew what they had been actually holding, and dumped.

Conversely, if a token just isn’t falling as a lot, there may be an above-average likelihood IMO that buyers additionally know what they’ve right here, and as a substitute of dumping they’re holding or accumulating extra.

Occasions like this are a present in some ways. You possibly can actually see issues much more clearly.

5 – All the previous narratives haven’t modified

Cash getting worse, irreversible debt and deficits, digital shortage, younger individuals all transferring in direction of digital all the pieces, BTC chain getting constructed out, variety of diamond fingers getting increasingly yearly, none of this has modified, neither is it ever more likely to.

Bear Case

Our one bear case remains to be in play, and that’s the TQQQ correlation. Go look. It dropped 12% in April, and BTC dropped 15%. When this correlation breaks long run, we might be in an excellent spot. Till then…

Conclusion

By now, you shouldn’t want me to inform you all of this, however a few of it’s possible you’ll be newer right here, or eat lots of wheat and soy and subsequently are extra emotional than your common NNFX fan.

In the event you imagine on this market, low costs are what you WANT proper now, earlier than the actual up-cycle begins.

When you begin seeing issues this fashion, you’ll develop bored of bull markets, and get excited for the drops.

That’s the way you’ll know you’ve made it.

— VP

Directions for putting in and configuring the Telegram to MT4/5 utility – Analytics & Forecasts – 29 December 2024 30 Dec 2024, 3:41 am

The Telegram to MT4/5 Coppy utility automates the method of copying buying and selling indicators from Telegram to MetaTrader 4 and MetaTrader 5 terminals. It is a highly effective device that helps merchants save time and handle dangers. On this article, we’ll look at intimately the method of putting in, configuring and utilizing the copier, and in addition clarify the that means of key variables.

Telegram to MT4/5 Coppy is top quality and performance at a really favorable worth.

🟡 Purchase for MT4 – https://www.mql5.com/ru/market/product/128293

🔵 Purchase for MT5 – Coming quickly

If you wish to take a look at the utility earlier than shopping for, you possibly can request a demo model. To do that, write me a non-public message . I’ll give you a limited-time model of this system with the intention to consider all its capabilities.

Putting in a copier

Along with the file within the MT4/5 terminal, you will have an EXE file (bridge for Telegram)

-

Downloading this system:

-

Set up:

-

Authorization in Telegram:

Establishing the utility

Including chats and filters

-

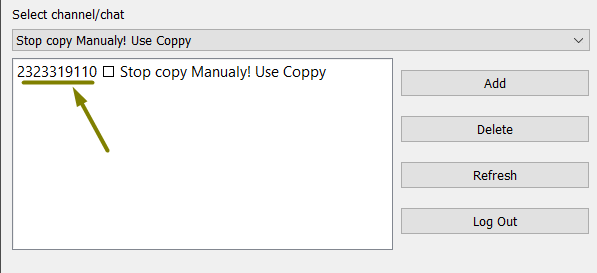

Including chats:

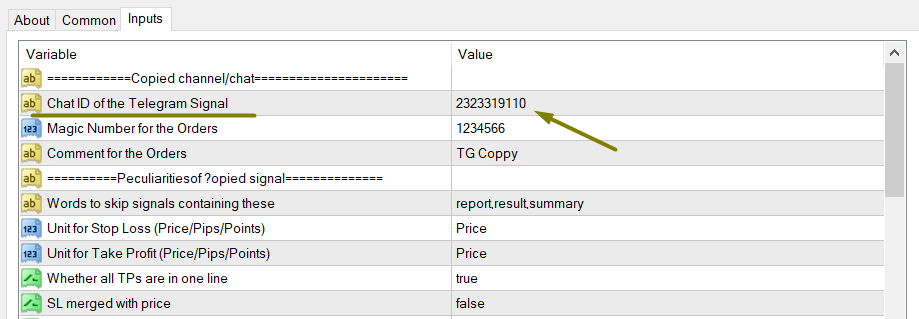

Subsequent, specify the chat ID within the utility on this column.

For 1 chat/channel you could open 1 separate chart and set up the utility there by coming into 1 chat ID and the required settings.

If you wish to copy indicators from 2 chats, then open one other chart and hold the utility there once more, coming into the identifier of solely the 2nd chat that you just need to copy, along with the identifier, specify one other magic quantity and a remark to the orders, this may will let you simply analyze statistics sooner or later and see which channel sends essentially the most worthwhile indicators.

-

Filters:

Danger setting

-

Deposit proportion:

-

Fastened lot:

-

Dangers:

Multi-Take Revenue

-

TP ranges:

-

Closing in elements:

Further features

-

Prohibition of copying trades with out Cease Loss / Take Revenue:

-

Multitasking:

-

Security:

Beginning the copier

-

Launching this system:

-

Begin copying:

-

Monitoring:

Key variables

-

TELEGRAM_CHAT_ID – ID of chats from which indicators are copied.

-

FILTER_KEYWORDS – key phrases for filtering indicators.

-

MAX_DAILY_RISK – most every day danger in proportion/deposit forex from the stability.

-

MAX_WEEKLY_RISK – most weekly danger in proportion/deposit forex from the stability.

-

MAX_MONTHLY_RISK – most month-to-month danger in proportion/deposit forex from the stability.

-

TAKE_PROFIT_LEVELS – Take Revenue ranges.

-

USE_FIXED_LOT – use of fastened lot (True/False).

-

RISK_PERCENT – proportion of the deposit for lot calculation.

Video about Telegram to MT4/5 Coppy

Conclusion

Telegram to MT4/5 Copier is a one-stop answer for merchants trying to automate their work and handle dangers successfully. Customise the utility to your wants and give attention to analytics, not handbook work.

Telegram to MT4/5 Coppy is top quality and performance at a really favorable worth.

🟡 Purchase for MT4 – https://www.mql5.com/ru/market/product/128293

🔵 Purchase for MT5 – Coming quickly

Darkish Venus Robotic Evaluate (#1 Free Buying and selling EA) 30 Dec 2024, 3:40 am

Darkish Venus is a Free Foreign exchange robotic, that I’ve used on a number of events.

I’ve turned $3000 into over $15,000 however I’ve additionally blown accounts with this EA.

So, I’ve a novel perspective, due to my stay buying and selling account expertise, which is why I’m going to present you an entire evaluation.

In addition to, some perception into how I might use this robotic on a stay account, at this time.

Darkish Venus Evaluate

Over the previous few months, I’ve been operating the Darkish Venus robotic on a $3000 stay buying and selling account. I truly documented your complete journey on this video right here:

I’d say the primary factor I realized from this 3 months, is simply how dangerous the EA is. Additionally, how essential it’s to learn your complete set up information, and use the proper settings file, as it’s with any of the Finest Foreign exchange Robots.

Despite the fact that, I inevitably blew your complete account, the truth that I used to be capable of greater than triple the account, means that there’s some worth right here.

You simply need to know when to drag the plug, earlier than the robotic runs into an unrecoverable drawdown.

I take advantage of this picture above to point out that in case you get caught in both greed, or delusion, the income you do have can shortly disappear in entrance of your eyes. Then, you fall into despair.

So how can we keep away from this? Let’s begin by wanting on the Darkish Venus EA technique.

Robotic Technique

The Darkish Venus buying and selling technique relies on the bollinger bands indicator.

This indicator is made up of three bands, with the center being a transferring common, and the higher and decrease being a set of normal deviations above or beneath that. Primarily, as there may be extra volatility the bands will widen, all the time making an attempt to comprise the value inside the bands.

The Darkish Venus Robotic will open purchase trades when the value is on the backside of the bands, and promote trades when the value is on the high of the bands. This takes benefit of the bollingers bands potential to comprise value inside these bands.

That is an efficient technique, as a result of the bollinger bands is named a dependable indicator.

Although, there may be one problem, and it’s a very appreciable problem.

If you take a look at the picture above you may see the value is in a spread. The value isn’t sharply transferring up or down. When this occurs, as a consequence of sharp will increase in volatility, the technique fails, and Darkish Venus takes some fairly important losses.

In my worst loss utilizing the robotic, it was a failure of technique. The EA did what it was programmed to do, it did a SELL commerce when value reached the highest band, with the expectation that value would come again to the center transferring common.

On this case it didn’t come again, as a rise of volatility wasn’t anticipated, and the robotic misplaced me a big quantity of my account.

Now, that is to be anticipated from a free buying and selling robotic.

I truly handled one thing related a couple of years in the past with my robotic, Foreign exchange Fury.

I discovered that my buying and selling technique additionally carried out significantly better in ranging market situations, scalping fast wins, and avoiding volatility. So, I built-in a spread detector to assist keep away from volatility, and solely place trades in ranging situations. Now this does restrict the quantity of trades that you just get, but it surely permits you to make the most of the robotic on extra pairs, and have a a lot greater win price.

That is positively my advice to the Darkish Venus EA robotic developer, if they need this software program to be one thing that may be trusted on a buying and selling account for greater than only a few weeks.

Darkish Venus Settings

I do have some suggestions on the subject of the Darkish Venus settings as effectively.

The error I made once I first began utilizing the robotic, is that I didn’t even search for settings on the MQL5 web site, I simply went proper into the defaults with $3000.

In doing so, I incurred a horrible loss shortly, with a drawdown of over 80% in my first couple of weeks.

Upon downloading the EURUSD M15 SET file, I used to be capable of get better my losses shortly, and even took the account to over $12,000 for a quadrupling.

However then, I saved growing the chance to try to take my income to the MOON.

Which admittedly, was a mistake.

I didn’t give the robotic sufficient room to breathe. This made for large wins, which made my account multiply so rattling shortly, but additionally made for large losses too which inevitably blew your complete account.

Darkish Venus Settings

You might be pondering at this level, how might this be attainable? How did the Darkish Venus Robotic blow a buying and selling account in simply over 2 months? Particularly, when it has lots of of 5 star evaluations.

Effectively, there’s a difficulty with the evaluations.

The picture above is a bit blurred, however you may learn “write a evaluation at market to obtain 1 paid indicator without cost!”

Now it doesn’t say 5 star Darkish Venus robotic evaluation, but it surely’s clear to me, that the developer is incentivizing constructive evaluations.

A variety of these evaluations are very primary, and the highest one is clearly simply doing this for the “free indicator.”

I can’t think about somebody would write a 1 star evaluation after which go “hey, right here’s the evaluation, the place’s my free indicator.” My assumption is that if somebody did that, they in all probability wouldn’t get a response again.

Can be an attention-grabbing factor to check, however I don’t like giving damaging evaluations, particularly when

Conclusion

So far as free robots go, the Darkish Venus EA is close to one of the best I’ve examined.

Despite the fact that it blew my account, I used to be utilizing it in a really dangerous method and even when it does blow accounts, then the consumer simply wants to grasp when to drag their income.

I simply might have pulled my income at $12,000 and this evaluation would have been very totally different, however I all the time let my checks go, if not only for the leisure worth it gives in my YouTube channel.

So, all in all, it’s fairly good.

I’d say in case you plan on utilizing it, apply it to demo first, get a really feel for it, and perceive that you’ll have to pull out your income, so don’t get too grasping and get caught on the fallacious finish of a bubble burst like I did.

In case you have something you wish to add to my Darkish Venus robotic evaluation, please depart a remark beneath. Inform me what I can do totally different subsequent time, and possibly I’ll give it one other shot!

Darkish Venus 0.0

- Pricing

- Technique

- Buying and selling Outcomes

- Consumer Suggestions

- Buyer Assist

Abstract

For those who’re trying to dip your ft into the buying and selling robotic waters, the Darkish Venus robotic is a fairly great way of doing so. It is going to present you that income can come fast, however so can losses, which makes it an excellent dose of actuality for any new dealer.

Execs

Free entry

Coded effectively

Particular technique

Free settings

My Ideas On Latest Market Volatility & The Coronavirus Disaster » Study To Commerce The Market 30 Dec 2024, 3:30 am

Pricey College students & Readers,

Given the quantity of inquiry I’m receiving from our readers and college students relating to the Coronavirus and the current market volatility, I really feel compelled to share my views on the scenario, from a buying and selling and investing perspective in addition to a private perspective.

I’ve produced this text in a query and reply format to finest handle the feedback and considerations lots of you’ve got despatched us over the previous few weeks.

Q: Will the LTTTM enterprise or service be interrupted by the Coronavirus scenario?

A:

I’m self-isolating at dwelling with my household, avoiding any exterior contact. The remainder of the LTTTM staff are additionally working from dwelling. Within the unlikely occasion I or a staff member turns into ailing, we’ve a contingency plan in place to proceed the LTTTM service. The present will go on, because it has performed since we began again in 2008.

Q: What do I take into consideration the Coronavirus scenario general and what am I doing?

A:

As I write the US fairness markets simply crashed circa 13% in a single day, the worst drop because the crash of 1987. The market is now down circa 30% to date this yr. This has been essentially the most unstable value motion I’ve ever witnessed in all my years of buying and selling.

Whether or not you consider the virus pandemic goes to eventuate into what the consultants are predicting, it has now turn into an nearly self-fulfilling market collapse. Merchants and investor’s confusion begin to dictate these unstable strikes reasonably than details and proof. Sadly, now that the markets have triggered this stage of technical injury, we could stay on this state of chaos for a while till we see the world beginning to present clear indicators of exiting this viral and financial disaster.

I’ve members in Italy, South Korea, China, and different significantly impacted areas who’ve shared regarding tales of simply how critical this virus scenario is. From all my discussions with well-connected people in addition to my very own in-depth analysis on-line (non-main stream media), it’s clear that this virus may be very critical and poses a threat to sure individuals in the neighborhood, particularly the older era and people individuals with present well being circumstances. Regardless of the huge risks to a big section of the inhabitants, the actual fact the world is now so conscious of the hazard of this virus and with all people making ready and bracing for the worst, the worldwide pandemic could come to an finish quicker than all of us anticipated, contact wooden.

It’s undoubtedly not a time to panic and run for the bomb shelters, however it’s a time to be vigilant, to have a plan, and to guard ourselves and our family members from doable an infection (particularly our older of us who’re most in danger).

At this stage, I’ve taken private precautions together with self-isolating myself and household from the skin world. I’ve stockpiled meals to final months if wanted (as I converse, the native shops are proscribing purchases and cabinets proceed to stay nearly empty). I’ve additionally requested my mother and father and older buddies to self-isolate from all individuals together with their very own household. I’ve additionally recommended they’ve meals delivered as a substitute of going out to shops and risking an infection. Most of my makes an attempt to assist my household and buddies put together for a possible worst-case state of affairs has fallen on deaf ears, so this has me a bit involved. Folks are inclined to consider it’s by no means going to occur to them, and in the end we are able to’t management others, we are able to solely actually management what we do ourselves.

Q: Why are the markets performing so loopy and is every little thing going to be okay?

A:

It is a true black swan.

The strikes within the markets have been each excessive and sudden. It is a true black swan (an sudden and unpredictable occasion that was extraordinarily tough or not possible to foretell), that’s inflicting real chaos to the world’s monetary markets and economies. The transfer has been exaggerated by individuals’s predictable panic and confusion, and like at all times, the pc algorithms (quants) are fueling the momentum behind many of those loopy each day actions within the markets.

The one factor to concern is ‘Concern’ itself

Most retail market members really consider the world is ending proper now, the extent of chaos in shares and commodities particularly is unprecedented. As a result of excessive value volatility, we all know that typical dealer and investor psychology will see many market members panic and make choices with out even understanding what is actually occurring. Some will inevitably be pressured to promote because of margin calls or just to boost capital to run their enterprise throughout this gradual economic system.

The issue we’ve right here is that panic and overreaction could certainly transform the reason for one other GFC as apposed to the Coronavirus disaster itself. Upon getting your complete world frightened of proudly owning monetary property and frightened of any type of journey and even leaving their home, you’ve got a self-fulfilling crash within the international economic system, whatever the true trigger. Concern and panic are the actual hazard to all of us right here and never simply virus pandemic itself.

Fed to the rescue ‘Once more’

Similar to we noticed again within the 2008/2009 GFC, the US Federal Reserve has simply introduced ‘no matter it takes’ rescue measures to attempt to stem the bleeding in monetary markets and credit score markets. International locations world wide and central banks are all working collectively to attempt to stimulate their respective native economies and to assist native companies climate the present financial storm. Sadly these rescue techniques won’t save each native enterprise and positively received’t save each listed firm. There’s going to be insolvency and bankruptcies because of the present disaster, and the worldwide inventory, credit score, and forex markets are pricing this in already.

Capitalism will proceed

Historical past has proven that the Reserve banks and Governments received’t enable the markets or economic system to break down. They’ve rescued the world earlier than and they’ll attempt to rescue it once more, so we should always stay optimistic. When the market lastly wakes as much as the thought that there’s a rescue mission from the banks and authorities on the way in which, issues will hopefully begin to stabilize, simply as they did again in 2008/2009 GFC and different disaster factors in current historical past.

It’s essential all of us perceive that it doesn’t matter what occurs proper now, this isn’t the ‘finish of days’, this isn’t the ‘finish of capitalism’ and issues will proceed usually proper the place they left off finally. It’s essential to remain optimistic as a result of for those who immerse your self in negativity, you’ll 1. add to the issue and a pair of. miss the massive buying and selling and investing alternatives upon us.

Q: Do I nonetheless suppose Trump will likely be re-elected in 2020?

A:

Each since I predicted Trump would win the 2016 election and made 500% + returns on that guess/commerce, individuals have been asking me about my ideas on Trump successful in 2020. My view is that the pandemic will hopefully be over by the November US presidential election. As a grasp of spinning any and all occasions in his favor, Trump will take credit score for saving lives via his response groups effort and bringing the disaster to a detailed. He’ll take credit score for the V-shaped inventory market restoration that can in the end happen after the pandemic subsides, his buddies on the US Federal Reserve will make certain it occurs. His present supporters and new silent supporters will emerge in large numbers and Trump will declare victory in November 2020 convincingly. There could also be alternatives to again Trump above even cash odds within the coming weeks/months forward, and that’s price maintaining a tally of. I would write a submit on this later within the yr.

Q: How am I buying and selling the present market circumstances?

A:

Search for alternatives all over the place.

For myself and different skilled merchants, there are wonderful alternatives to commerce the brief time period swings and developments throughout a variety of markets. In current weeks there have been a plethora of commerce entry alternatives providing excessive risk-reward payoffs. Now we have seen wonderful volatility in Gold, S&P 500, Crude Oil, and all Main FX Pairs, simply to call a couple of.

The affected person dealer waits to commerce the swings by looking forward to value motion alerts to establish the brief time period turning factors OR they wait to commerce the developments by looking forward to retracements to key ranges and utilizing value motion alerts to establish when the prevailing development momentum will resume.

For buyers, there are wonderful alternatives to choose up long run investments in strong corporations they’ve had on their funding buying checklist. Professionals don’t panic in these conditions, they’re salivating on the alternatives to revenue and so they embrace these sorts of market circumstances.

Give trades room to maneuver, these are uncommon instances.

It’s essential throughout this excessive volatility that merchants give their trades room which implies utilizing a wider cease loss and an adjusted place measurement. For example, while retaining the identical $ in danger per commerce, you could commerce 1 lot as a substitute of two tons. You could use a wider cease lack of 400 factors as a substitute of 200. Bear in mind, wider stops don’t imply extra threat for those who cut back place measurement. Do the maths and watch your threat.

Use the loopy market circumstances and newly discovered free time to study and apply your craft.

In case your like myself and intend to spend the following few weeks/months at dwelling working or simply laying low on weekends as a substitute of going out to see family and friends, it is best to use this newly discovered free time to focus in your self-education, to examine up in your buying and selling strategy and training your buying and selling methods in real-world circumstances. There has by no means been a greater time to immerse your self within the markets, it’s an thrilling time to study and an thrilling time to commerce.

Closing ideas:

Prefer it or not, the privileged elite few management this world, and so they have managed it for a really very long time. The monetary markets are one mechanism they use to switch wealth and to regulate the wealth. They received’t let the sport received’t cease, the world will proceed and firms and folks will return to regular within the not too distant future. It has at all times been this fashion for the previous few centuries since capitalism started and it’s not going to alter any time quickly. So keep optimistic and issues will finally return to regular and life will go on. Within the meantime, attempt to make your self some cash and capitalize on the plentiful buying and selling and investing alternatives upon us.

What do you suppose is actually occurring on the market on this planet and within the markets proper now? What have you ever been buying and selling or buying and selling? How are you planning for the following few weeks and months forward? Speak to me by leaving your feedback under and I’ll reply to each remark.

Keep protected and good buying and selling,

Nial Fuller

Gold Coast, Australia

March seventeenth, 2020

Pattern Power and Fractal Help and Resistance Foreign exchange Buying and selling Technique 30 Dec 2024, 3:16 am

Pattern Power and Fractal Help and Resistance Foreign exchange Buying and selling Technique is a robust strategy designed to assist merchants navigate the complexities of the international alternate market. By integrating two essential parts—development power indicators and fractal assist and resistance ranges—this technique gives a complete framework for figuring out worthwhile commerce alternatives. The mix of those instruments helps merchants not solely perceive the prevailing market development but additionally pinpoint key value ranges the place potential reversals or breakouts are more likely to happen, resulting in extra knowledgeable and assured buying and selling choices.

Pattern power is a vital think about figuring out whether or not a market is in a powerful uptrend, downtrend, or consolidating. Using indicators just like the Common Directional Index (ADX) or Pattern Power indicators, merchants can assess the momentum behind a forex pair’s motion. A transparent understanding of development power allows merchants to align their positions with the dominant market route, avoiding the pitfalls of buying and selling towards the prevailing development. In essence, development power helps merchants establish when a market is trending strongly sufficient to assist a worthwhile commerce.

Fractal assist and resistance, however, concentrate on the important thing value ranges the place the market has traditionally reversed. These ranges are decided by fractal patterns, that are fashioned by the highs and lows of value motion inside a specified interval. By recognizing these fractal patterns, merchants can anticipate future value actions and establish zones of assist or resistance. When mixed with development power, fractal assist and resistance ranges turn out to be much more highly effective, serving to merchants establish the almost definitely entry and exit factors for his or her trades. This technique not solely presents the chance to experience the development but additionally to take action with higher precision and lowered threat.

Pattern Power Indicator

The Pattern Power Indicator is a necessary device for Foreign exchange merchants who want to assess the power of a market development. It helps establish whether or not a forex pair is in a powerful uptrend, downtrend, or if the market is consolidating in a sideways motion. Among the many hottest development power indicators are the Common Directional Index (ADX) and Pattern Power Indicator (TSI), each of which give worthwhile insights into market momentum.

The ADX, developed by J. Welles Wilder, ranges from 0 to 100 and helps merchants decide how sturdy the present development is. An ADX worth under 20 suggests a weak or non-existent development, whereas a worth above 25 signifies a powerful development. When the ADX rises above 40, it alerts a really sturdy development, and merchants can search for alternatives to align their trades with this prevailing momentum. Equally, the Pattern Power Indicator measures the depth of a development, providing a extra refined studying of whether or not the market is gaining or dropping momentum.

The important thing benefit of utilizing a development power indicator is that it prevents merchants from getting into trades throughout market consolidation or sideways motion, that are much less predictable and riskier. By ready for the indicator to substantiate a powerful development, merchants can enter the market with greater confidence, bettering their possibilities of success. Moreover, by combining the Pattern Power Indicator with different instruments, equivalent to fractal assist and resistance, merchants can establish ultimate entry and exit factors, making certain they’re buying and selling with the market’s momentum.

Fractal Help and Resistance Indicator

The Fractal Help and Resistance Indicator is one other invaluable device for Foreign exchange merchants, used to establish key value ranges the place value motion is more likely to reverse. Primarily based on the idea of fractals—repeating value patterns that emerge at varied ranges of the market—this indicator identifies factors the place the worth has reversed or stalled up to now. These fractal factors usually sign potential assist or resistance areas which might be essential for profitable commerce choices.

Fractals are fashioned by a collection of highs and lows, usually recognized by a central peak or trough flanked by two decrease peaks or greater troughs on both facet. Within the context of Foreign currency trading, fractals point out areas the place value has beforehand turned, providing clues as to the place it’d reverse once more. Fractal assist happens on the lowest level of a downward value motion, whereas fractal resistance happens on the highest level of an upward motion. By recognizing these ranges, merchants can establish zones the place value motion is more likely to stall or reverse, creating the proper circumstances for organising entries and exits.

When mixed with the Pattern Power Indicator, fractal assist and resistance ranges turn out to be much more highly effective. For instance, if a powerful development is confirmed by the Pattern Power Indicator and the worth reaches a fractal resistance degree, merchants can count on a possible reversal or breakout. Equally, a value drop to a fractal assist degree in a powerful downtrend might current a possible quick entry. Fractal assist and resistance present a dynamic technique for understanding market construction, serving to merchants make extra exact and efficient buying and selling choices together with development evaluation.

How you can Commerce with Pattern Power and Fractal Help and Resistance Foreign exchange Buying and selling Technique

Purchase Entry

- Use the Pattern Power Indicator (equivalent to ADX) to substantiate that the market is in a powerful uptrend (ADX above 25 and rising).

- Find a fractal assist degree within the uptrend. That is the place value has beforehand reversed upward.

- Await the worth to strategy the fractal assist degree.

- Search for a bullish reversal sample on the assist degree (e.g., bullish engulfing, hammer, or different bullish candlestick patterns).

- Be certain that the Pattern Power Indicator (ADX) remains to be above 25 and rising, indicating sturdy momentum.

- As soon as the worth reveals a reversal sample on the fractal assist degree, enter a purchase commerce.

- Place the cease loss barely under the fractal assist degree.

- Set the take revenue on the subsequent vital fractal resistance degree or based mostly in your most popular risk-to-reward ratio (e.g., 2:1).

Promote Entry

- Use the Pattern Power Indicator (equivalent to ADX) to substantiate that the market is in a powerful downtrend (ADX above 25 and falling).

- Find a fractal resistance degree within the downtrend. That is the place value has beforehand reversed downward.

- Await the worth to strategy the fractal resistance degree.

- Search for a bearish reversal sample on the resistance degree (e.g., bearish engulfing, capturing star, or different bearish candlestick patterns).

- Be certain that the Pattern Power Indicator (ADX) remains to be above 25 and falling, indicating a powerful downtrend.

- As soon as the worth reveals a reversal sample on the fractal resistance degree, enter a promote commerce.

- Place the cease loss barely above the fractal resistance degree.

- Set the take revenue on the subsequent vital fractal assist degree or based mostly in your most popular risk-to-reward ratio (e.g., 2:1).

Conclusion

The Pattern Power and Fractal Help and Resistance Foreign exchange Buying and selling Technique presents a robust and structured strategy to navigating Forex. By combining the Pattern Power Indicator, such because the ADX, with Fractal Help and Resistance ranges, merchants can align their trades with the prevailing market momentum whereas figuring out key value zones the place value motion is more likely to reverse or escape. This mixture enhances the chance of getting into high-probability trades, minimizing the chance of false breakouts and bettering total buying and selling accuracy.

Really helpful MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 50% Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here under to obtain:

Save

Save

The Greatest Methods For Inexperienced persons To Commerce Foreign exchange In 2024 30 Dec 2024, 3:07 am

Are you a newbie trying to enterprise into the world of Foreign currency trading and wish to be taught The Greatest Methods for Inexperienced persons to Commerce Foreign exchange? With its immense revenue potential, Foreign currency trading has grow to be more and more in style amongst people within the monetary markets. Nevertheless, diving into Foreign currency trading with out the fitting data and techniques may be dangerous. On this weblog put up, we’ll information you thru the very best methods for newbies to commerce Foreign exchange efficiently. By following the following pointers, you may improve your probabilities of making knowledgeable buying and selling selections and reaching long-term success.

Understanding Foreign exchange Buying and selling

Earlier than we delve into the methods, it’s essential to grasp the fundamentals of Foreign currency trading. Foreign exchange, quick for overseas trade, is the worldwide decentralized marketplace for buying and selling currencies. In contrast to the inventory market, Foreign exchange operates 24 hours a day, permitting merchants to purchase and promote currencies from completely different nations. The purpose is to revenue from the fluctuations in forex trade charges.

Develop a Stable Basis

To grow to be a profitable Foreign exchange dealer, it’s important to construct a stable basis of information. Begin by educating your self about Foreign exchange terminology, market developments, and elementary and technical evaluation. There are quite a few on-line programs, tutorials, and eBooks out there that will help you grasp the important thing ideas of Foreign currency trading. Moreover, think about opening a demo account with a good dealer to apply buying and selling with out risking actual cash.

Select the Proper Foreign exchange Dealer

Deciding on a dependable Foreign exchange dealer is essential in your buying and selling journey. Search for brokers which can be regulated by respected monetary authorities and provide aggressive spreads, a user-friendly buying and selling platform, and responsive buyer help. Conduct thorough analysis and browse critiques to make sure you select a dealer that fits your wants and gives a safe buying and selling atmosphere.

| Dealer | Bonus | Min Deposit | Payout | Overview | Open Account |

|---|---|---|---|---|---|

| 100% Deposit Bonus | CashBack (Rebates) | Free Buying and selling VPS | Contests | | 1$ | Overview | Go to Dealer | ||

|

Deposit Bonus | Free Demo Account With out Deposit | Buying and selling Contests | 10$ | Overview | Go to Dealer | |

|

2.021$ Foreign exchange No Deposit Bonus, Foreign exchange No Deposit Demo Account, 300% Deposit Deposit Bonus, CashBack as much as 20$ / Lot, Free EasyBot, Buying and selling Indicators | 1$ | Overview | Go to Dealer | |

|

2,000$ No Deposit Bonus | as much as 100% Deposit Bonus | Buying and selling Contests | 1$ | Overview | Go to Dealer | |

|

30$ Foreign exchange No Deposit Bonus & 120% Deposit Bonus | 10$ | Overview | Go to Dealer | |

|

Deposit 10$ for 30$ Bonus | Traditional bonus as much as 120% | Revenue Share Bonus as much as 60% | Money Again (Rebates) | 10$ | Overview | Go to Dealer | |

|

Take SabioTrade cash and commerce (Nearly a No Deposit Bonus), and maintain 90% of the revenue for your self. You commerce, SabioTrade take the dangers | 50$ | Overview | Go to Dealer | |

|

88$ + 99$ No Deposit Bonus | as much as 3.000% Deposit Bonus | Buying and selling Contests | 1$ | Overview | Go to Dealer | |

|

Free Demo Account With out Deposit | Free Buying and selling Bots | Free Buying and selling Academy | Free or Paid MT5 Buying and selling Indicators | 5$ | as much as 200% for Binary Choices | Overview | Go to Dealer |

|

30$ Foreign exchange No Deposit Bonus, as much as 50% Deposit Bonus, Free VPS, XM Loyalty Program, Contests with Massive Prizes | 5$ | Overview | Go to Dealer |

Create a Buying and selling Plan

Having a well-defined buying and selling plan is important for newbies and skilled merchants alike. Your buying and selling plan ought to define your targets, threat tolerance, most popular buying and selling model, and techniques for coming into and exiting trades. Persist with your plan and keep away from impulsive selections primarily based on feelings. Keep in mind, profitable buying and selling requires self-discipline and endurance.

Make the most of Elementary and Technical Evaluation

Elementary and technical evaluation are two frequent approaches utilized in Foreign currency trading. Elementary evaluation entails learning financial indicators, information releases, and geopolitical occasions that affect forex values. Alternatively, technical evaluation depends on charts, patterns, and indicators to foretell worth actions. Each approaches have their deserves, and a mix of the 2 can present beneficial insights in your buying and selling selections.

Implement Threat Administration Methods

Managing threat is essential in Foreign currency trading. One frequent rule is to threat solely a small share of your buying and selling capital on every commerce, usually not more than 2-3%. This manner, even in case you encounter a collection of losses, you gained’t wipe out your whole account. Moreover, utilizing stop-loss orders and take-profit orders will help you shield your income and restrict potential losses.

Steadily Requested Questions (FAQs) – The Greatest Methods for Inexperienced persons to Commerce Foreign exchange

Q: How a lot cash do I want to start out buying and selling Foreign exchange? A: The amount of cash required to start out buying and selling Foreign exchange varies relying on the dealer and your buying and selling technique. Some brokers help you open an account with as little as $100, whereas others could require larger minimal deposits. It’s advisable to start out with an quantity you may afford to lose and regularly improve your funding as you acquire expertise.

Q: Is Foreign currency trading dangerous?

A: Like every type of funding, Foreign currency trading carries dangers. The market is risky, and costs can fluctuate quickly. Nevertheless, with correct schooling, threat administration methods, and disciplined buying and selling, it’s attainable to attenuate dangers and improve your probabilities of success.

Q: Can I commerce Foreign exchange part-time? A: Sure, Foreign currency trading affords flexibility, permitting you to commerce part-time. Many merchants begin by buying and selling alongside their common jobs. Nevertheless, it’s vital to allocate devoted time for evaluation, staying up to date on market information, and executing trades successfully.

Q: What are the very best forex pairs for newbies? A: As a newbie, it’s advisable to give attention to main forex pairs resembling EUR/USD, GBP/USD, or USD/JPY. These pairs are extremely liquid and sometimes exhibit clear developments and buying and selling alternatives.

Q: Ought to I depend on Foreign exchange robots or automated buying and selling programs? A: Whereas Foreign exchange robots and automatic buying and selling programs may be tempting, they don’t seem to be foolproof. It’s essential to grasp the underlying methods and take a look at them totally earlier than counting on them. In the end, studying to commerce manually will give you a greater understanding of the market dynamics.

Conclusion – The Greatest Methods for Inexperienced persons to Commerce Foreign exchange

In conclusion, Foreign currency trading generally is a rewarding enterprise for newbies, but it surely requires dedication, schooling, and apply. By understanding the elemental ideas, selecting the best dealer, creating a buying and selling plan, and implementing threat administration methods, you may set a stable basis in your Foreign currency trading journey. Keep in mind to remain disciplined, frequently educate your self, and adapt to market situations. With time and expertise, you may improve your probabilities of reaching success in Forex.

Start your Foreign currency trading journey in the present day and embrace the alternatives it affords. As at all times, begin with small investments, acquire expertise, and regularly improve your buying and selling capital. By following the very best practices outlined on this weblog put up, you’ll be effectively in your approach to changing into a assured and profitable Foreign exchange dealer.

Blissful buying and selling!